Where: IN Person at Bellevue Library

Meeting Starts: 11am, ends at 1pm so bring a snack.

REAPS new FIRE Group!! in Bellevue

Saturday at 11 AM

REAPS Members Free

Guests: $15

Registration required for all events CLICK HERE

Navigating the Early Stages of Business Creation

with

Elay Mor

CEO of DynoMind

~

Elay helps small companies navigate tech challenges.

He has started several businesses and worked with small business.

(He also has a business in the stock market data area if that interests you.)

~

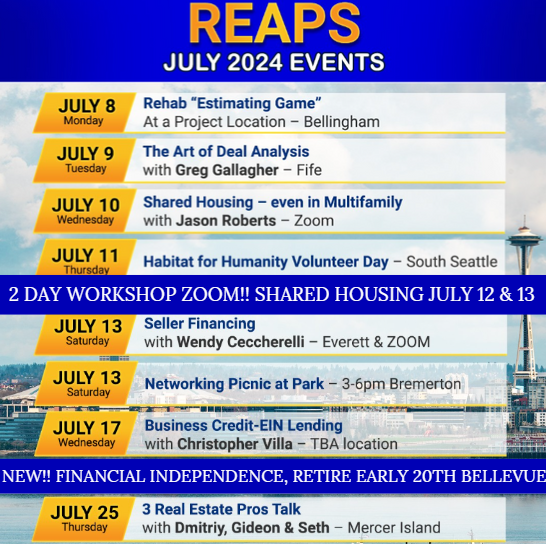

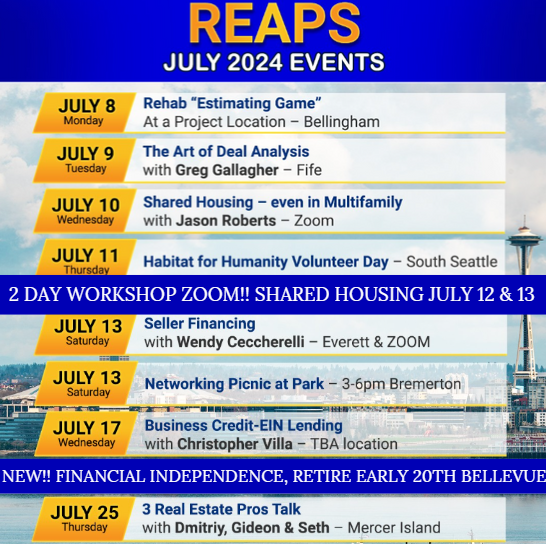

--- Bringing the FIRE Movement to Bellevue!! ---

~

The F.I.R.E. Movement is about being thrifty strong saver, strategic with smart investing, and maybe entrepreneurial, so that you can retire early!

F.I.R.E. = Financial Independence, Retire Early

More details below...

~Two local investors have volunteered to co-lead the FIRE group

Hamed Dadgour & Alex Kaplan

~

Upcoming AUGUST 17th meeting will be Ruth a Reporter and REAPS member turned world traveller using points. She'll give us the scoop!

~

About Our Moderators....

Hamed Dadgour - AI Tech innovator and Real Estate Investor

Hamed Dadgour - AI Tech innovator and Real Estate Investor

Alex Kaplan- 10 years ex-Googler turned full time RE investor and entrepreneur

Alex Kaplan- 10 years ex-Googler turned full time RE investor and entrepreneur

REAPS Members Free

Guests: $15, Guests Your First time is FREE use promo code "guest"

Registration required for all events CLICK HERE

Never been to a REAPS meeting before? The first time is free! Type "Guest" in the promo code.

From Wikipedia: The FIRE (Financial Independence, Retire Early) movement is a lifestyle movement with the goal of gaining financial independence and retiring early. The model became particularly popular among millennials in the 2010s, gaining traction through online communities via information shared in blogs, podcasts, and online discussion forums.

Those seeking to attain FIRE intentionally maximize their savings rate by growing the gap between their living expenses and their income, and investing the difference. JL Collins, an author who has been called the "godfather" of financial independence, has advocated:

"Spend less than you earn—invest the surplus—avoid debt. Do simply this and you'll wind up rich."

The objective is to accumulate assets until the passive income from these assets provide enough money to cover living expenses. Some proponents of the FIRE movement suggest the 4% rule as a rough withdrawal guideline, thus setting a goal of at least 25 times one's estimated annual living expenses. Others, such as economist Karsten Jeske, suggest planning for a more conservative withdrawal rate such as 3.25% or 3.5% (accumulating around 28 to 30 times one's estimated annual living expenses) when planning to retire very early.

When a person reaches financial independence, paid work becomes optional, allowing them to pursue new activities or retire before reaching a typical retirement age.

Background

FIRE is achieved through aggressive saving, far more than the standard 10–15% typically recommended by financial planners. Assuming expenses are equal to income minus savings, and neglecting investment returns, observe that:

- At a savings rate of 10%, it takes (1-0.1)/0.1 = 9 years of work to save for 1 year of living expenses.

- At a savings rate of 25%, it takes (1-0.25)/0.25 = 3 years of work to save for 1 year of living expenses.

- At a savings rate of 50%, it takes (1-0.5)/0.5 = 1 year of work to save for 1 year of living expenses

From this example, it can be concluded that the time to retirement decreases significantly as savings rate is increased. For this reason, those pursuing FIRE attempt to save 50% or more of their income. At a 75% savings rate, it would take less than 10 years of work to accumulate 25 times the average annual living expenses suggested by 'the 4% safe withdrawal' rule.

There are several ways to pursue FIRE. Some of the best-known are:

LeanFIRE: LeanFIRE is about achieving financial independence earlier by living exceedingly frugally. With very low expenses, a smaller investment portfolio is needed to achieve financial independence.

FatFIRE: FatFIRE is a strategy for achieving financial freedom and early retirement with a larger budget than traditional retirement planning. Unlike other FIRE methods that may focus on minimalism and reducing expenses, Fat FIRE allows for a more luxurious lifestyle in retirement. This approach requires saving and investing a significant portion of income to build a substantial nest egg, enabling individuals to retire earlier than conventional retirement age while maintaining a higher standard of living.

CoastFIRE: CoastFIRE has at least two stages. In the first, an investor aggressively saves and builds their investment portfolio. This continues until the investor is satisfied that their portfolio will grow sufficiently through the power of compound interest alone. In the second stage, the investor can stop or reduce their investing, and enjoy a measure of freedom without being fully financially independent.

BaristaFIRE: BaristaFIRE allows people to partially retire before they are fully financially independent. It involves switching to a less-demanding (usually part-time) job that provides some income, and perhaps benefits such as health insurance. (The term is a reference to part-time jobs at Starbucks, which provide health insurance.) With this approach, a person covers their living expenses with income as well as modest withdrawals from an investment portfolio. During this period, the investment portfolio should continue to grow.

FIRE is viewed as a lifestyle, not simply an investment strategy. A common thread that challenges individuals that subscribe to the FIRE lifestyle is finding partners that share the same fiscal goals. Availability of online resources helps the movement to expand among Millennial high-net-worth individuals.

The emergence of social media has brought more attention to workers discussing their dissatisfaction. "Social media has made lives appear more glorious and expensive, but also allows others to broadly share about their financial freedom." said Zachary A. Bachner, CFP of Summit Financial.

Prev Month

Prev Month View Month

View Month Search

Search Go to Month

Go to Month Next Month

Next Month

Hamed Dadgour - AI Tech innovator and Real Estate Investor

Hamed Dadgour - AI Tech innovator and Real Estate Investor Alex Kaplan- 10 years ex-Googler turned full time RE investor and entrepreneur

Alex Kaplan- 10 years ex-Googler turned full time RE investor and entrepreneur

Export Event

Export Event